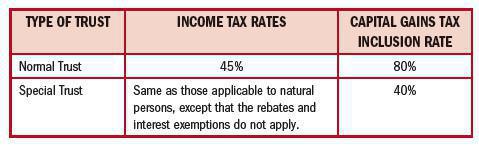

TAX RATES

Tax rates applicable to trusts are as follows:

Note: A special trust is a trust created solely for the benefit of someone who suffers from a disability that prevents such person from earning sufficient income for their maintenance or from managing their own financial affairs. A special trust can also be created by way of a testamentary trust whereby relatives of the testator who are alive on the date of death are the beneficiaries. In order to qualify as a special trust, the youngest of the beneficiaries must, on the last day of the year of assessment of that trust, be under the age of 18 years.

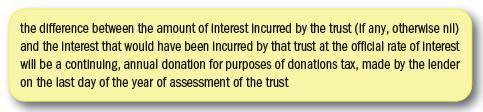

INTEREST-FREE AND LOW-INTEREST LOANS TO A TRUST

With effect 1 March 2017 loans made to a trust by

- a natural person, or

- at the instance of that person, a company in relation to which that person is a connected person, and where that person or company is a connected person in relation to the trust

Loans by a natural person or a company to a company is also subject to donation tax on the same basis if 20% or more of the shares of the company is held directly or indirectly by a trust (or beneficiary of trust or spouse of beneficiary). Preference shares issued by a company are also regarded as loans for this donation tax calculation.

The following will be specifically excluded from the above donation provisions:

- special trusts that are created solely for the benefit of disabled persons

- trusts that fall under public benefit organisations

- vesting trusts (in respect of which the vesting rights and contributions of the beneficiaries are clearly established)

- loans used by the trusts to fund the acquisition of a primary residence

- loans that are subject to transfer pricing provisions

- loans provided to the trust in terms of a sharia-compliant financing arrangement, or

- loans that are subject to dividends tax

- loans to employee share purchase trusts

The lender may utilise the annual donations tax exemption of R100 000 (or remaining portion if applicable) against this deemed donation. No deduction, loss, allowance or capital loss may be claimed in respect of the reduction, waiver or other disposal of such a loan, advance or credit by the lender and will thus have no tax benefit for the lender.

OTHER ANTI-AVOIDANCE PROVISIONS

Anti-avoidance provisions exist to combat the use of trusts for income splitting and tax avoidance schemes. These provisions will normally be applicable where income accrues to a person other than the donor as a result of a donation, settlement or other disposition made (i.e. interest free loans). These provisions may apply where income accrues to the following persons:

- The donor’s spouse, a minor child of the donor, the trust to whom the donation, settlement or other disposition has been made, and non-residents.

The result of the anti-avoidance provisions are that the income that accrues to the person’s mentioned above are deemed to be the income of the donor.

CHECKLIST WHEN BUYING OR SELLING A PROPERTY FROM A TRUST

- Review the Trust deed Review the clauses pertaining to the powers and authority of the Trustees to act. They must have the requisite capacity to contract on behalf of the trust regarding the acquisition or disposal of property, or power to obtain a mortgage bond or pass a mortgage bond over any immovable property held in trust by them.

- Letters of Authority Trustees must be duly authorised to act in terms of the most recent Letters of Authority issued by the Master of the High Court, or Master’s Certificate, if the trustees have changed.

- FICA Obtain all signing Trustees’ Identity documents, and other FICA documentation.

- Board of Trustees The Board must be properly constituted. The minimum number of Trustees required by the Trust Deed must be appointed.

- Administrative requirements Provided the Trustees are authorised by the trust deed to delegate their authority to act, they must then issue the necessary authority for one Trustee to act on their behalf, failing which, all Trustees are required to sign the necessary documentation. A prior resolution of Trustees is required authorising the purchase or sale of any immovable property in the name of the Trust. If this is not effected, all of the Trustees will be required to sign the Deed of Sale.